I was horrified by the contents of one of my Finnish mutual funds when I looked into it after years of disinterest. I’m especially disgusted by UnitedHealth Group Inc - the health insurance company whose mass murderer CEO got shot recently, sparking nationwide cheers.

As a passive investor, you’ll forget your money into the wrong hands when the bank won’t remind you of developments in the political situation.

Ålandsbanken promises:

“socially sustainable”

You may assume your bank is civilised, but you should have a closer look. I’m a customer of S-bank in Finland. In this case, the fund ended up under a different Finnish bank twice due to buyouts, and the management of the fund ended up in a Canadian bank branch in the UK.

My other bank didn’t recommend selling my Russian investment when Putin’s reign had started going overdue after his full term as a president. Luckily I was awake and sold everything.

Investments drift out of balance over time. Within mutual funds, there are limits, but the funds grow at different rates. You should re-balance your diversification once in a while to avoid excessive country risk.

I don’t know if fund managers are bribed to distort the balance within the fund’s limits for the benefit of a third party.

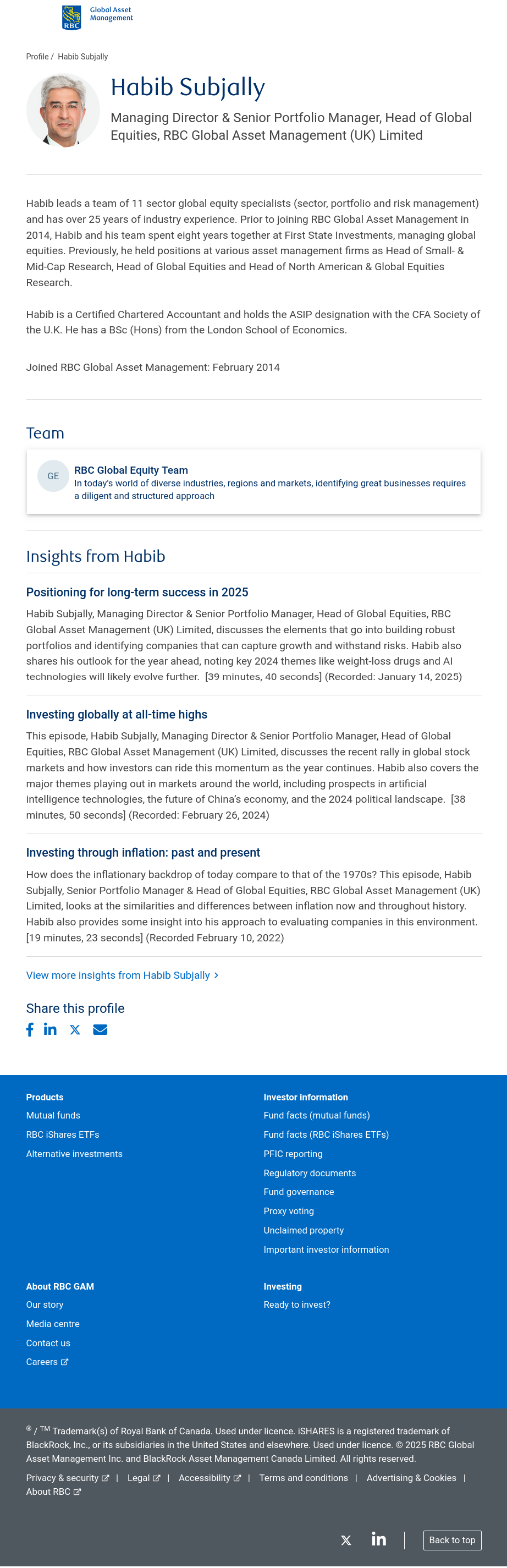

My fund is managed by that guy. I sold everything. Will reinvest in Europe.

I think the most ethical thing to do is to help the most ethical companies trying to stay clean in a dirty economy. Surely there are good-enough ones in all countries and sectors. Makers of wind turbines, solar panels, batteries, cable, bicycles, electric vehicles (trains and trams!), etc. ASML, TSMC, Tuxedo Computers, Fairphone, etc.

I agree with you and your examples generally, but then that sounds like “active investing” which I have neither the time nor the “risk appetite” for.

On the topic of active investing, I’ve been led to believe there is some case for investing in brown/unethical companies (eg oil industry) on the basis that the investment only be used for green projects. Obviously this isn’t something an individual investor could do, but the principle is that a massive oil company like Shell could do more good with a large investment, bringing in large coordinated green programmes or just undoing their brown programmes, than that same investment split up into lots of smaller and newer green companies with different goals, lots of independent overhead etc.

I’m as equipped to make the argument as I am able to enact it, but I think it’s an interesting thought at least.

Sure, if you or a consortium control a majority of voting shares, you can make the company do whatever you want. Doesn’t seem very realistic to me.

The activity can be limited, and so can the risk:

Once in about 5 years, buy a diversified portfolio of 30 companies in at least 10 countries on at least 2 continents in at least 3 unrelated industries, and forget for 5 years.

Maybe prefer to buy in a depression and sell on a bubble if you’re feeling extra active. Just be sure to diversify in time to avoid accidentally investing everything on top of a bubble.

It’s easy nowadays through many banks’ websites. I use Nordnet.

Between stock sprees, save into a regular savings account.