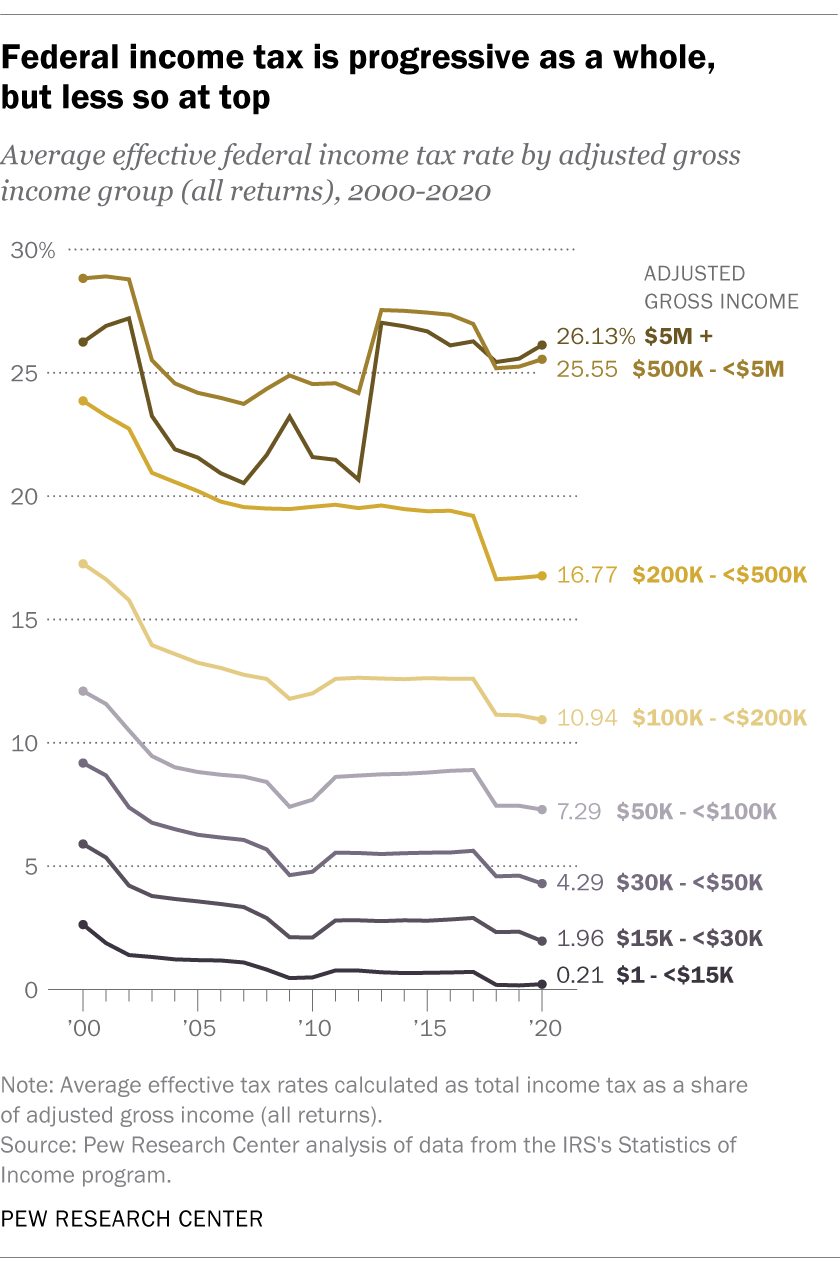

we ofc already have graduated tax brackets but it needs to be shifted upwards so that people making below a certain amount should pay zero Income taxes (I’m not talking about a wealth tax or carbon tax or VAT tax).

also, top marginal rates NEED TO BE INCREASED AGAIN. during WWII the wealthiest paid between 80-95%. from the New Deal until Reagan destroyed the country in the 80s, top rates were well above 50 percent.

Taxing the ultra rich is how America funded higher education, built the highway system, funded social welfare, uplifted 2 generations, built a global manufacturing and technology economy, and created a prosperous middle class. we did it by keeping oligarchs in check. in a strictly enforced progressively tiered system, top marginal tax prevents the obscene accumulation of wealth

we ofc already have graduated tax brackets but it needs to be shifted upwards so that people making below a certain amount should pay zero Income taxes (I’m not talking about a wealth tax or carbon tax or VAT tax).

also, top marginal rates NEED TO BE INCREASED AGAIN. during WWII the wealthiest paid between 80-95%. from the New Deal until Reagan destroyed the country in the 80s, top rates were well above 50 percent.

Taxing the ultra rich is how America funded higher education, built the highway system, funded social welfare, uplifted 2 generations, built a global manufacturing and technology economy, and created a prosperous middle class. we did it by keeping oligarchs in check. in a strictly enforced progressively tiered system, top marginal tax prevents the obscene accumulation of wealth